Featured

Table of Contents

Note, nevertheless, that this does not state anything regarding changing for inflation. On the bonus side, even if you presume your choice would be to purchase the securities market for those seven years, which you would certainly get a 10 percent yearly return (which is much from particular, particularly in the coming years), this $8208 a year would certainly be more than 4 percent of the resulting nominal supply worth.

Example of a single-premium deferred annuity (with a 25-year deferral), with 4 repayment choices. Courtesy Charles Schwab. The month-to-month payout right here is greatest for the "joint-life-only" alternative, at $1258 (164 percent greater than with the prompt annuity). The "joint-life-with-cash-refund" alternative pays out only $7/month less, and assurances at the very least $100,000 will be paid out.

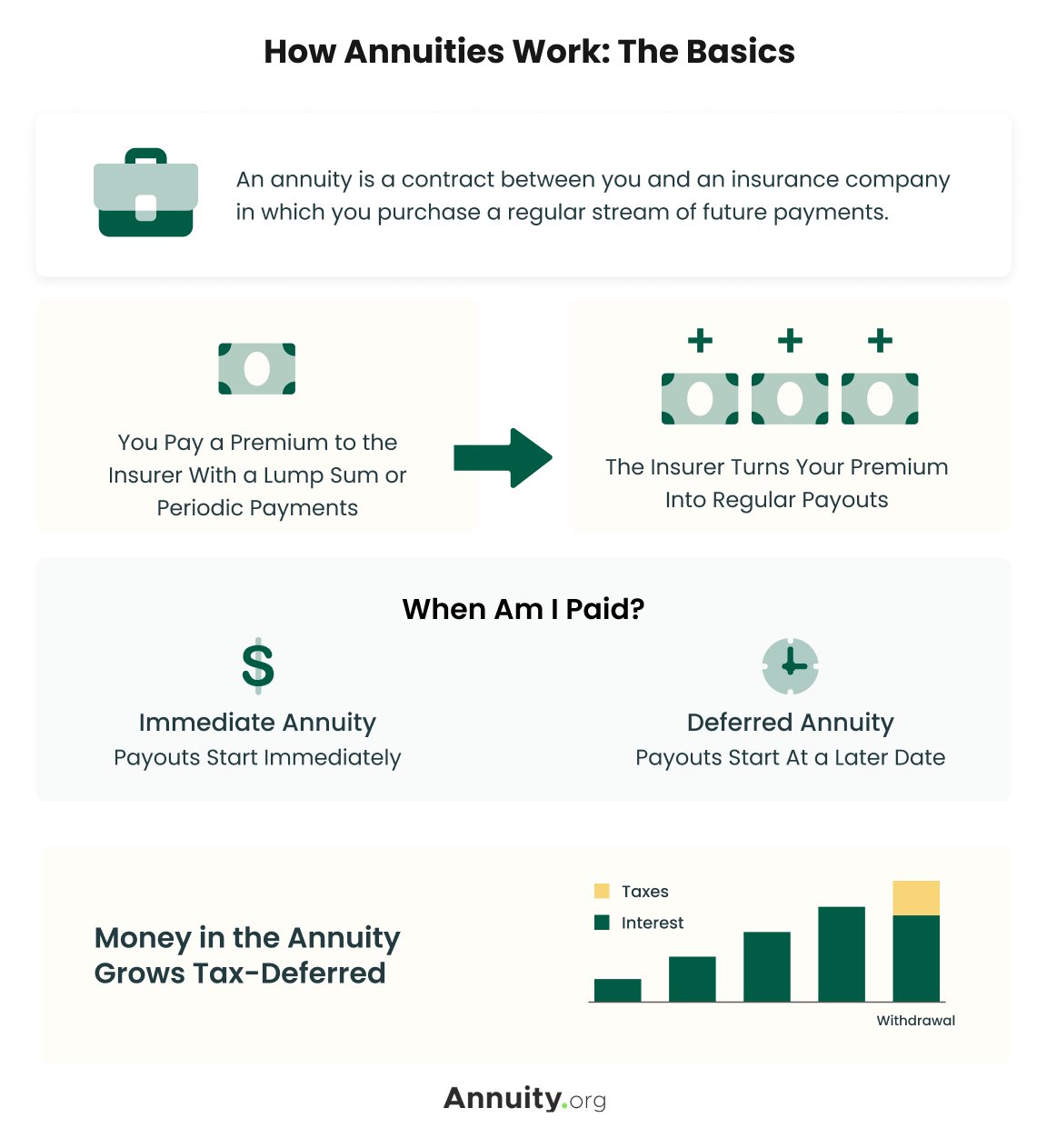

The way you buy the annuity will certainly determine the solution to that question. If you buy an annuity with pre-tax bucks, your costs decreases your taxed income for that year. Eventual settlements (monthly and/or lump amount) are taxed as normal earnings in the year they're paid. The benefit here is that the annuity may let you defer taxes beyond the IRS contribution limits on Individual retirement accounts and 401(k) strategies.

According to , buying an annuity inside a Roth strategy results in tax-free payments. Buying an annuity with after-tax bucks outside of a Roth results in paying no tax on the part of each payment associated to the original costs(s), but the remaining part is taxable. If you're setting up an annuity that begins paying before you're 59 years of ages, you might have to pay 10 percent early withdrawal penalties to the internal revenue service.

Retirement Income From Annuities

The consultant's primary step was to develop a comprehensive economic strategy for you, and after that clarify (a) how the recommended annuity matches your general strategy, (b) what choices s/he taken into consideration, and (c) just how such options would certainly or would certainly not have caused lower or greater payment for the expert, and (d) why the annuity is the remarkable selection for you. - Lifetime payout annuities

Of training course, a consultant might attempt pushing annuities even if they're not the very best suitable for your circumstance and objectives. The reason can be as benign as it is the only item they offer, so they drop prey to the typical, "If all you have in your toolbox is a hammer, quite soon whatever begins appearing like a nail." While the consultant in this scenario may not be dishonest, it enhances the threat that an annuity is a bad selection for you.

Is there a budget-friendly Annuity Withdrawal Options option?

Considering that annuities typically pay the agent selling them a lot greater compensations than what s/he would get for investing your money in mutual funds - Tax-deferred annuities, let alone the zero compensations s/he 'd receive if you invest in no-load common funds, there is a large incentive for representatives to push annuities, and the more difficult the much better ()

An underhanded consultant suggests rolling that amount into new "much better" funds that just occur to carry a 4 percent sales load. Concur to this, and the advisor pockets $20,000 of your $500,000, and the funds aren't most likely to execute much better (unless you chose a lot more badly to start with). In the exact same example, the consultant might guide you to get a complicated annuity keeping that $500,000, one that pays him or her an 8 percent compensation.

The consultant tries to rush your decision, claiming the deal will quickly disappear. It may without a doubt, but there will likely be similar deals later on. The consultant hasn't figured out how annuity settlements will be tired. The advisor hasn't divulged his/her settlement and/or the costs you'll be billed and/or hasn't revealed you the influence of those on your ultimate settlements, and/or the compensation and/or charges are unacceptably high.

Your family background and existing wellness indicate a lower-than-average life expectancy (Annuity contracts). Existing rate of interest, and therefore forecasted settlements, are historically reduced. Also if an annuity is appropriate for you, do your due persistance in comparing annuities marketed by brokers vs. no-load ones sold by the issuing company. The latter might need you to do even more of your own research study, or use a fee-based financial consultant who might obtain payment for sending you to the annuity company, but may not be paid a greater payment than for various other financial investment alternatives.

Is there a budget-friendly Guaranteed Return Annuities option?

The stream of month-to-month settlements from Social Safety is comparable to those of a deferred annuity. Since annuities are volunteer, the individuals purchasing them generally self-select as having a longer-than-average life expectancy.

Social Safety and security advantages are completely indexed to the CPI, while annuities either have no inflation protection or at most supply a set percentage yearly rise that might or may not make up for rising cost of living in full. This kind of motorcyclist, as with anything else that enhances the insurance company's danger, needs you to pay even more for the annuity, or approve lower settlements.

How do I choose the right Deferred Annuities for my needs?

Please note: This short article is meant for informative functions just, and must not be taken into consideration financial advice. You must speak with a financial professional prior to making any type of significant financial decisions.

Since annuities are meant for retirement, tax obligations and penalties may use. Principal Protection of Fixed Annuities.

Immediate annuities. Deferred annuities: For those that desire to expand their cash over time, yet are ready to postpone accessibility to the money up until retired life years.

How do I receive payments from an Annuity Payout Options?

Variable annuities: Provides higher capacity for growth by investing your cash in financial investment options you choose and the capability to rebalance your portfolio based upon your choices and in a manner that lines up with altering economic goals. With fixed annuities, the firm spends the funds and offers a rate of interest price to the client.

When a fatality case happens with an annuity, it is essential to have a named recipient in the contract. Various alternatives exist for annuity survivor benefit, depending on the contract and insurance company. Picking a reimbursement or "period certain" choice in your annuity supplies a survivor benefit if you pass away early.

What is the difference between an Retirement Annuities and other retirement accounts?

Calling a beneficiary various other than the estate can aid this procedure go a lot more efficiently, and can help ensure that the profits go to whoever the specific desired the money to go to rather than going with probate. When present, a death benefit is immediately included with your contract.

Table of Contents

Latest Posts

Understanding Financial Strategies Key Insights on Fixed Income Annuity Vs Variable Annuity What Is the Best Retirement Option? Benefits of Deferred Annuity Vs Variable Annuity Why Choosing the Right

Exploring the Basics of Retirement Options Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Indexed Annuity Vs Fixed

Analyzing Fixed Indexed Annuity Vs Market-variable Annuity Everything You Need to Know About Indexed Annuity Vs Fixed Annuity What Is Deferred Annuity Vs Variable Annuity? Features of Choosing Between

More

Latest Posts